Asset protection (sometimes also referred to as debtor-creditor law) is a set of legal techniques and a body of statutory and common law dealing with protecting assets of individuals and business entities from civil money judgments. The goal of asset protection planning is to insulate assets from claims of creditors without perjury or tax evasion.

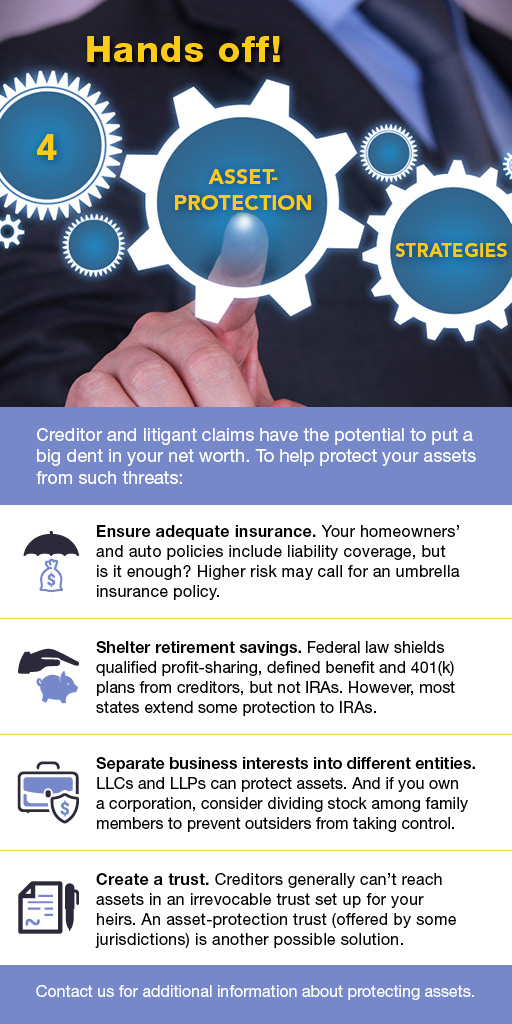

1. Ensure Adequate Insurance

Your homeowners’ and auto policies include liability coverage, but is it enough? Higher risk may call for an umbrella insurance policy

Tip: It’s best to make this five minute phone call before you receive the inheritance or windfall.

2. Shelter Retirement Savings

Federal law shields qualified profit sharing, defined benefit and 401(k) plans from creditors, but not IRAs. However, most states extend some protection to IRAs.

3. Separate business interests into different entities.

LLC’s and LLPs can protect assets. And if you own a corporation, consider dividing stock among family members to prevent outsiders from taking control.

4. Create a Trust

Creditors generally can’t reach assets in an irrevocable trust set up for your heirs. An asset-protection trust (offered by some jurisdictions) is another possible solution.

The Most Common Asset Protection Mistake

If you try to start asset protection planning after a lawsuit has been filed against you, or even if before the lawsuit is filed you anticipate it being filed, then you will be exposing any asset protection planning that you attempt to do to attacks and reversal by a judge or jury.

Unfortunately, too many people are learning far too late that asset protection planning is also long-term planning, not something that can be done as a quick or temporary fix. Thus, the time to put your asset protection plan together is long before a lawsuit is on the horizon.

Contact us for additional information about protecting assets. We’d be happy to help.

To learn more about asset protection visit, https://en.wikipedia.org/wiki/Asset_protection/