Earlier this month, the United States Department of Labor (DOL) published regulations that modified certain provisions of the Fair Labor Standards Act (FLSA). Specifically, the regulations increase the minimum salary for an employee to be exempt from FLSA overtime requirements. The following are some frequently asked questions regarding these changes.

Changes to FLSA Overtime Rules

Q: What is the Fair Labor Standards Act (FLSA)?

A: The FLSA, also known as the federal Wage and Hour Law, regulates minimum wage, overtime, equal pay, recordkeeping, and child labor. Under the FLSA, employees are classified as either exempt or nonexempt from the minimum wage and overtime.

Note: Some states and local jurisdictions have their own wage and hour laws, which may provide greater protection for employees than what is provided under the FLSA. Where federal, state, and local laws conflict, the law that is most beneficial to the employee prevails.

Q: To whom does the FLSA apply?

A: The FLSA applies to virtually all employers, including:

- Employers with employees engaged in interstate commerce (defined broadly, such as assembling products that are sent out of state or regularly making phone calls to another state or engaging in business using the Internet);

- Enterprises (including nonprofits) with gross sales or business of $500,000 or more per year;

- Hospitals; enterprises engaged in the care of the sick, the aged, or the mentally ill who reside on the premises; a school for mentally or physically disabled or gifted children; a preschool, an elementary or secondary school, or an institution of higher education (whether operated for profit or not for profit); and

- Public agencies.

Q: What is the difference between an exempt and nonexempt employee?

A: Under the federal FLSA, a nonexempt employee is one who is entitled to at least the minimum wage for each hour worked and overtime whenever he or she works more than 40 hours in a workweek. Any employee may be classified as nonexempt. By contrast, an exempt employee isn’t entitled to the minimum wage or overtime, but the employee must satisfy certain tests to be classified as exempt.

Q: For nonexempt employees, what is the overtime rate?

A: Under federal law, the overtime rate is 1.5 times the employee’s regular rate of pay. An employee’s “regular rate of pay” includes their hourly rate plus the value of nondiscretionary bonuses, shift differentials, and certain other forms of compensation. However, there are certain types of compensation that are excluded from the regular rate of pay.

Note: Depending on the circumstances, some states have different overtime rates. For instance, California requires two times an employee’s regular rate of pay for all hours worked over 12 in a workday.

Q: Can I just pay overtime to nonexempt employees at a flat sum instead of calculating it each week? For example, I know that if I pay my employees a flat sum of $500 each week for overtime, this will cover any and all overtime they work in a workweek.

A: No. You must calculate and pay overtime to nonexempt employees on a per-hour basis. You may not pay employees a flat sum for all overtime worked, even if it would be greater than what is owed on a per-hour basis.

Q: If I pay an employee a salary, does that mean he or she is an exempt employee?

A: Not necessarily. To be classified as exempt, employees must generally satisfy all of the following tests:

- The employee must be paid on a salary basis, meaning the employee must receive his or her full salary in any workweek in which the employee performs work (regardless of the quality or quantity of that work);

- The salary must meet or exceed the minimum requirements for exemption; and

- The employee must perform specific job duties. Each type of exemption has its own set of primary duties that an employee must perform in order to qualify for the exemption.

New Rules

Q: What is changing in the new rule?

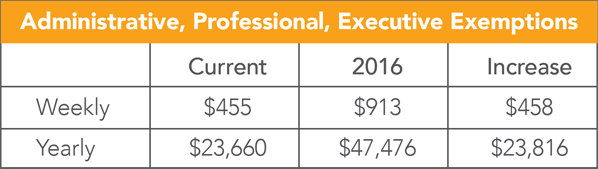

A: The minimum salary requirement for the administrative, professional, executive, and highly compensated employee exemptions have increased substantially.

Previously, the minimum salary requirement for the highly compensated employee exemption was $100,000 per year. The DOL increased this minimum to the 90th percentile for full-time salaried employees, which is $134,004.

Q: Does it change the duties tests?

A: The DOL did not have any specific changes to the duties tests.

Q: May employers use bonuses or incentives to satisfy part of the new standard salary level test?

A: Yes. Under the new rules, the DOL allows nondiscretionary bonuses and incentive payments (including commissions) to satisfy up to 10 percent of the standard salary test requirement. For example, employers could use nondiscretionary incentive bonuses tied to productivity or profitability. For employers to credit these amounts toward a portion of the standard salary level test, such payments must be paid on a quarterly or more frequent basis.

Q: I am a small employer. Am I covered by the rule?

A: Virtually all employers are covered by the FLSA and, therefore, any subsequent changes to the FLSA.

Q: How will future increases to the minimum salary requirement work?

A: The DOL change increases the minimum salary requirement every three years, beginning on January 1, 2020. The DOL will publish the revised salary levels at least 150 days before the updated rates would take effect.

Q: My state has its own rules for exemption from overtime. Do those change?

A: The new rules under the FLSA are applicable at the federal level.

Some states, such as California, may make changes to their minimum salary requirements for exemption as a result of the new federal rule. However, states aren’t required to make any changes. Generally, where federal, state, and local laws conflict, the law that is most beneficial to the employee prevails.

Options to Consider

Q: What must I do to comply with the new rules?

A: If your exempt employees’ salaries fall below the new minimum, you will generally either have to:

- Raise their salaries to the new minimum salary level (if you elect this option, review their job duties to ensure they continue to qualify for the applicable exemption); or

- Reclassify the affected employees as nonexempt and pay them overtime whenever they work more than 40 hours in a workweek.

Q: Would both of these options increase my compensation costs?

A: It depends on which option you choose and how many hours your exempt employees typically work per week.

If you raise employees’ salaries to meet the new requirement, your compensation costs willincrease.

40 hours per week schedule:

If the potentially impacted employees rarely work more than 40 hours in a week and you don’t want to increase your compensation costs, you could reclassify these employees as nonexempt and convert their salary to an hourly wage (divide their weekly salary by 40 hours). These employees would be entitled to overtime if they work more than 40 hours in a workweek.

40+ hours per week schedule:

If the potentially impacted employees regularly work more than 40 hours per week and you want to keep your compensation costs the same, then you would need to account for the overtime premium as part of the new hourly rate.

Q: To keep my overtime costs down, can I adopt a policy that prohibits employees from working overtime unless approved by their supervisor in advance?

A: Yes, you may adopt such a policy, but remember that even if employees violate the policy, you will still have to pay them overtime if they work more than 40 hours in a workweek. While you may subject them to discipline for violating your policy, you may never withhold overtime pay.

For additional insights and resources, visit adp.com/flsa.

ADP Compliance Resources

ADP maintains a staff of dedicated professionals who carefully monitor federal and state legislative and regulatory measures affecting employment-related human resource, payroll, tax and benefits administration, and help ensure that ADP systems are updated as relevant laws evolve. For the latest on how federal and state tax law changes may impact your business, visit the ADP Eye on Washington Web page located at www.adp.com/regulatorynews.

ADP is committed to assisting businesses with increased compliance requirements resulting from rapidly evolving legislation. Our goal is to help minimize your administrative burden across the entire spectrum of employment-related payroll, tax, HR and benefits, so that you can focus on running your business. This information is provided as a courtesy to assist in your understanding of the impact of certain regulatory requirements and should not be construed as tax or legal advice. Such information is by nature subject to revision and may not be the most current information available. ADP encourages readers to consult with appropriate legal and/or tax advisors. Please be advised that calls to and from ADP may be monitored or recorded.