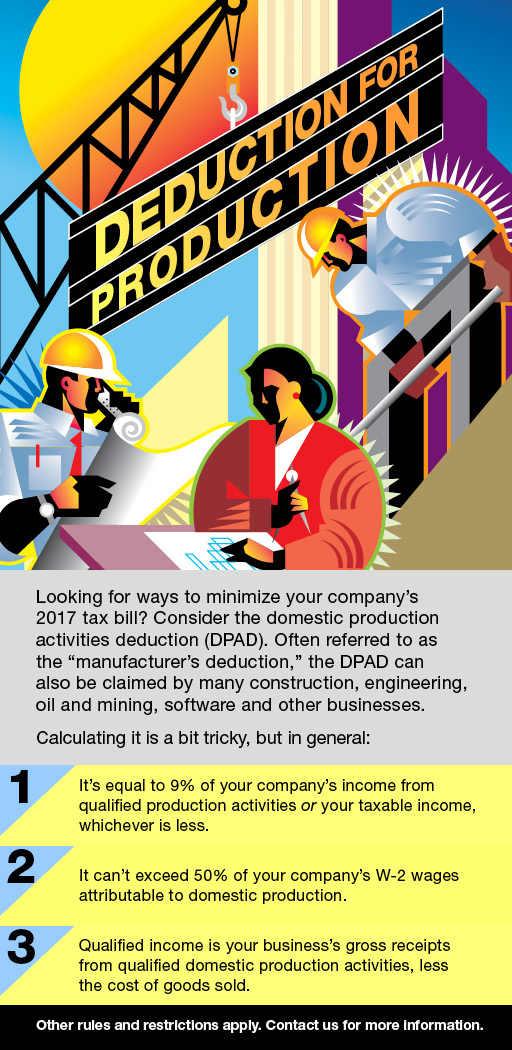

Looking for ways to minimize your company’s 2017 tax bill? Consider the domestic production activities deduction (DPAD). Often referred to as “manufacturer’s deduction,” the DPAD can also be claimed by many construction engineering, oil and mining, software and other business.

Calculating it is a bit tricky, but in general:

- It’s equal to 9% of your company’s income from qualified production activities of your taxable income, whichever is less.

- It can’t be exceed 50% of your company’s W-2 wages attributable to domestic production.

- Qualified income is your business’s gross receipts from qualified domestic production activities, less the cost of goods sold.

Other rules and restriction apply. Contact us for more information.