The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak. The filing deadline for tax returns has been extended from April 15 to July 15, 2020. The IRS urges taxpayers who are owed a refund to file as quickly as possible. For those who can’t file by the July 15, 2020 deadline, the IRS reminds individual taxpayers that everyone is eligible to request an extension to file their return.

News

Families First Coronavirus Response Act (FFCRA) Compliance Recommendations

Employers with fewer than 500 employees should review policies and practices to ensure compliance with the Families First Coronavirus Response Act and train supervisors on how to respond when employees request such leave. You will find summarized notes from the Families First Coronavirus Response Act below:

Here are sample policies on Emergency Paid Sick Leave and Public Emergency Health Leave required by the Act.

If you have questions please contact us at (479) 249-9916.

DOL Issues Final Overtime Rule

After much anticipation, on September 24, 2019, the U.S. Department of Labor (DOL) has announced its long-awaited Final Overtime Rule to update the federal overtime regulations governing which employees are entitled to minimum wage and overtime pay under the federal wage and hour law by increasing the salary level required under the executive, administrative and professional (EAP) white-collar exemptions. The Final Overtime Rule is effective as of January 1, 2020.

IRS Has Begun Sending Letters to Virtual Currency Owners

The IRS has begun sending letters (Letters 6173, 6174, and 6174-A) to taxpayers who:

- Potentially failed to report income and pay the resulting tax from virtual currency transactions

- Did not properly report virtual currency transactions.

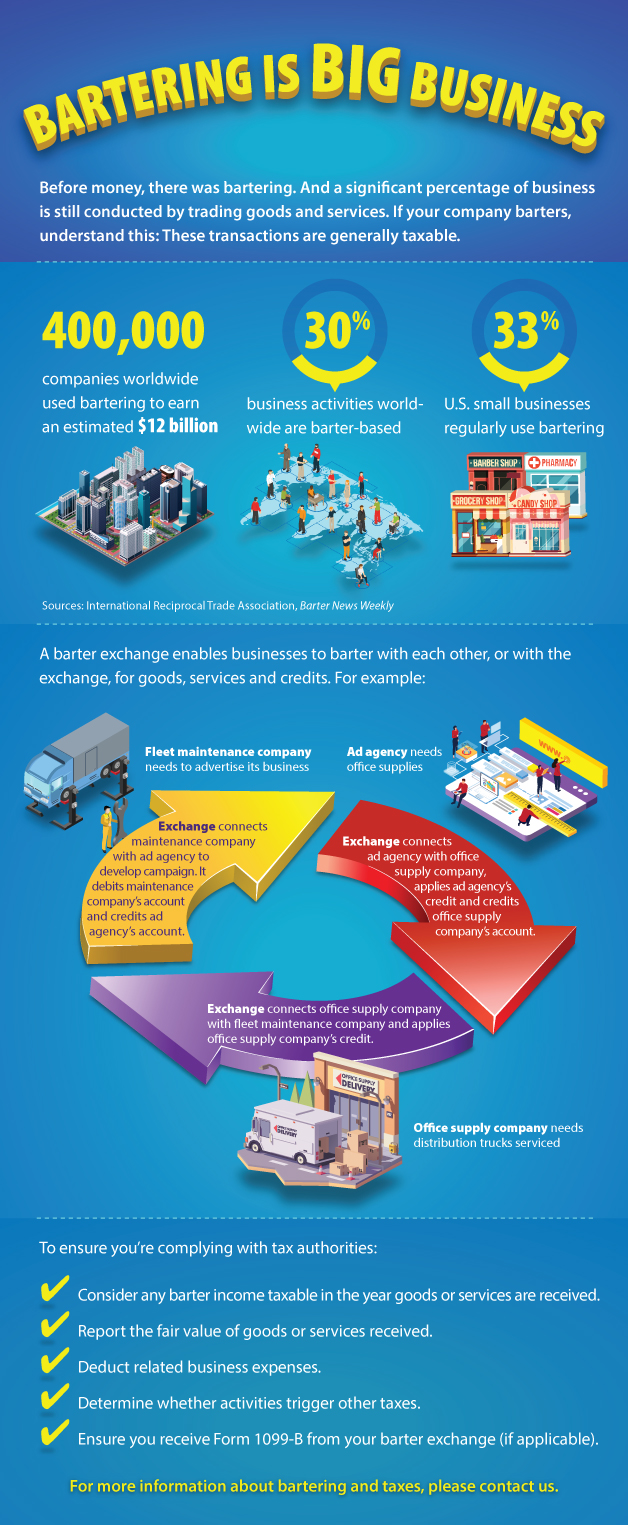

Bartering is BIG Business

Before money, there was bartering. And a significant percentage of business is still conducted by trading goods and services. If your company barters, understand this: These transactions are generally taxable.

- 400,000 companies worldwide used baartering to earn an estimated $12 billion.

- 30% business activities world-wide are barter-based.

- 33% U.S. small business regularly use bartering.

A barter exchange enables business to barter with each other, or with the exchange, for goods, services and credit, For example:

Fleet maintenance company needs to advertise

1. Exchange connects maintenance company with ad agency to develop campaign. It debits maintenance company’s account and credits ad agency’s account.

2. Exchange connects ad agency with office supply company, applies ad agency’s credit and credits office supply company’s account.

3. Exchange connects office supply company with fleet maintenance company and applies office supply company’s credit.

To ensure you’re complying with tax authorities:

- Consider any barter income taxable in the year goods or services received.

- Report the fair value of goods or services received.

- Deduct related business expenses.

- Determine whether activities trigger other taxes.

- Ensure you receive Form 1099-B from your barter exchange (if applicable).

For more information about bartering and taxes, please contact us.

Charitable Tax Deductions IRS Rules

If reducing your taxable estate is an important estate planning goal, making lifetime charitable donations can help achieve that goal and benefit your favorite organizations. In addition, by making donations during your lifetime, rather than at death, you can claim income tax deductions. But some of your charitable deductions could be denied if you don’t follow IRS rules.

Is your employer withholding enough in taxes?

The IRS has updated its 2018 withholding tables to reflect provisions of the Tax Cuts and Jobs Act. Employers use these tables to determine withholding from employees’ paychecks. But it’s your responsibility to ensure you’re withholding enough.

Only certain trusts can own S corporation stock

An S corporation must comply with several strict requirements or risk losing their tax-advantaged status. Among other things, they can have no more than 100 shareholders, can have no more than one class of stock and are permitted to have only certain types of shareholders.

In an estate planning context, it’s critical that any trusts that will receive S corporation stock through operation of your estate plan be eligible shareholders.

4 Asset Protection Strategies

Asset protection (sometimes also referred to as debtor-creditor law) is a set of legal techniques and a body of statutory and common law dealing with protecting assets of individuals and business entities from civil money judgments. The goal of asset protection planning is to insulate assets from claims of creditors without perjury or tax evasion.

Impact of mileage rates and gas prices on tax deductions

If you drive for work, you may pay attention when the IRS updates the standard mileage rate used to deduct business driving expenses. The rate rises most years, but it also falls occasionally. That’s because mileage rates follow gas prices.

For 2017, the standard mileage rates are:

- 53.5 cents per mile for business miles driven, down from 54 cents for 2016.

- 17 cents per mile driven for medical or moving purposes, down from 19 cents for 2016.

- 14 cents per mile driven in service of charitable organizations.